Site Language:

Follow Us

Join our newsletter

Get the latest news delivered to your inbox.

Valiant Capital Offers Simple Access to The ERC Program and ERC Advance Options

The COVID-19 pandemic resulted in many companies needing to make modifications to day-to-day operations to remain afloat. As one of the nation’s fastest-growing private financial services firms, Valiant Capital has helped qualifying businesses receive millions of dollars in tax credits for sticking by their full-time employees through the recent period of economic hardship. Particularly, Valiant Capital has stepped to the plate to help small businesses continue their recovery from the challenges of the Pandemic, specifically to generate and access funds from the Employee Retention Credit (ERC) Program.

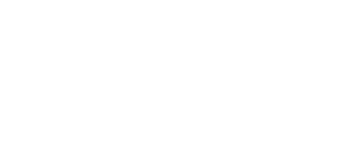

What is The Employee Retention Credit (ERC)?

The Employee Retention Credit is a refundable tax credit claimed on quarterly payroll tax filings. Recognizing the need to keep American workers employed, this tax credit was first enacted in March 2020 as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Later it was modified and extended with the Taxpayer Certainty and Disaster Tax Relief Act (December 2020), with the American Rescue Plan Act (ARP) (March 2021), and again in November 2021 with the Infrastructure Investment and Jobs Act.

The ERC is available to all businesses (including non-profits) that have been negatively impacted by Covid-19. This impact can be identified by either:

- The business’s operations are fully or partially suspended due to a government order limiting commerce, travel, or group meetings.

- A 50% reduction in gross receipts in any quarter in 2020 in comparison to the same quarter in 2019, or a 20% reduction in gross receipts in any quarter in 2021 as compared to the same quarter in 2019, or the previous quarter.

- New Businesses, if operations commenced after Feb 15th, 2020, and if revenues are less than $1 million annually.

If your company is eligible, the business can obtain reimbursement of payroll taxes of up to $5,000 per W-2 employee for 2020 and potentially up to $21,000 per W-2 employee for 2021, totaling a maximum potential of $26,000 combined. If you started your business after February 15, 2020, it could be considered a “recovery startup business”. If so, the maximum credit is $50,000 per quarter, up to $100,000 maximum.

Is The Employee Retention Credit Taxable?

The ERC is not includible in gross income, but it is subject to expense disallowance rules.

How to Claim The ERC?

To be eligible for the ERC, businesses must submit their total qualified W-2 wages along with the associated health insurance expenditures on a quarterly basis (Form 941 for most employers).

Particularly, this program does not have a cap on how much money it can spend, unlike the PPP. Being so, this lets employers use the program at a more leisurely pace because they do not have to worry about running out of money. However, it does has computational and eligibility requirements, some of which can be difficult to comprehend; this is where Valiant Capital can become a major partner in helping businesses from all industries take on the ERC program.

Talk to Qualified Experts about The ERC

ERC specialists like Valiant Capital have especially made the process risk-free and easy for business owners tackling the ERC. With an experienced team of financial analysts and management, Valiant Capital has helped hundreds of businesses nationwide with the ERC as well as provided continuing education to CPAs on applying and better understanding credits. Businesses that are interested fill out a quick portal with their basic information for a preliminary call. If a business chooses to proceed, the Valiant Capital team would guide the business through the process all to submitting on behalf to the IRS. Having a financial service firm like Valiant Capital who are specialized in tax programs like the ERC, ensures businesses can fully maximize their refundable payroll tax credit potential.

ERC Advance Option

Valiant Capital is also recognized as one of four firms nationally that can advance the ERC credit, which drastically increases the value of money received from the ERC instead of waiting months to use the capital that otherwise would be lost to inflation on the rise, furthermore why Valiant Capital could be a great partner in navigating the ERC. Businesses that are having trouble making ends meet may find this to be of great assistance.

What is the Deadline for the ERC?

For all qualified wages paid in 2020, the deadline to claim the ERC is April 15, 2024, while the deadline is April 15, 2025, for all qualified wages paid in 2021.

An important note to consider, the IRS is currently making changes to the credit limits that will take effect in early 2023 which will reduce the ERC credit amount. For this reason, it is a timely issue for business owners to request ERC credits sooner rather than later to maximize the credit potential.

For More Information, Contact:

Maria Martinez

Regional Sales Director

maria@valiant-capital.com

210-259-9647

Hola!

Have a question or wondering how you can get involved with the San Antonio Hispanic Chamber of Commerce?

Join the SAHCC Newsletter

Sign up below to be included in our email updates so you always are in the know!